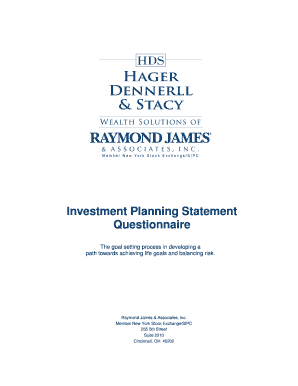

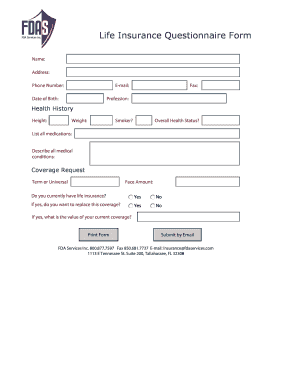

StrategicPoint Financial Planning Questionnaire free printable template

Show details

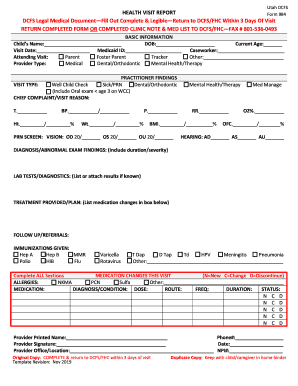

Financial Planning Questionnaire To complete this form by hand 1 Print all pages of this form. 1 Save this writable PDF to your computer then open it using Adobe s Acrobat Reader. Annual expenses for other dependents for example parents Estate Planning Do you have updated wills Do you have powers of attorney Have you executed health care proxies When were these documents last updated Have you established any trusts If yes names of trust s you have established Whom may we thank for referring...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign financial planning fact finder form

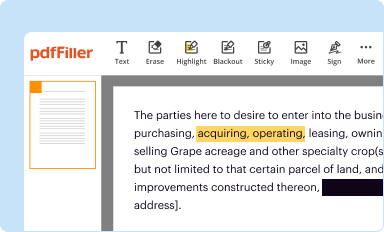

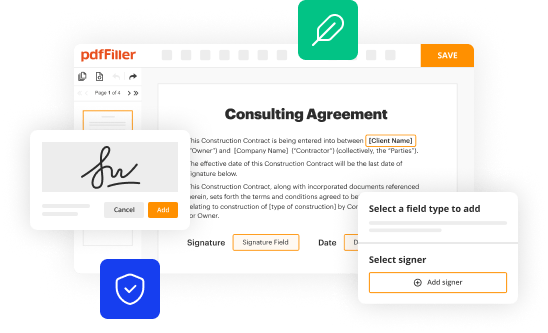

Edit your financial planning fact finder template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

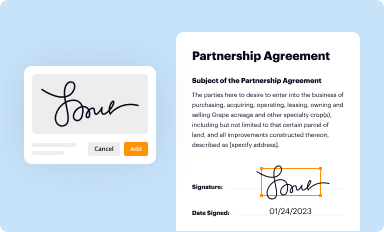

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

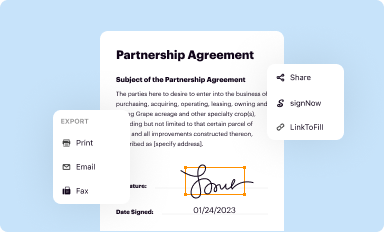

Share your form instantly

Email, fax, or share your fact find template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business fact find template online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fact find questionnaire form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out end to end document management 58 votes form

How to fill out StrategicPoint Financial Planning Questionnaire

01

Read the introduction section to understand the purpose of the questionnaire.

02

Gather your financial documents such as income statements, expenses, assets, and debts.

03

Start with personal information: provide your name, age, and marital status.

04

Fill in your income details: list your sources of income and monthly amounts.

05

Detail your expenses: record all monthly and annual expenses including fixed and variable costs.

06

List your assets: include cash, investments, property, and valuable possessions.

07

Document your liabilities: record all debts including loans, mortgages, and credit card balances.

08

Answer questions regarding your financial goals: specify short-term and long-term objectives.

09

Assess your risk tolerance: indicate your comfort level with different types of investments.

10

Review your responses for accuracy and completeness before submitting the questionnaire.

Who needs StrategicPoint Financial Planning Questionnaire?

01

Individuals or families looking to assess their financial situation.

02

Those preparing for retirement and needing a financial plan.

03

Clients seeking professional financial advice from a planner.

04

Anyone wanting to set financial goals and track progress over time.

05

People interested in investment strategies tailored to their financial profile.

Fill

the purpose of the strategicpoint search

: Try Risk Free

People Also Ask about financial adviser fact find template

What is a fact finder financial planning?

Financial planning fact finder. Our financial planning process involves discussing your goals, gathering pertinent data, designing solutions, and delivering a cohesive plan that you can implement to help you reach your goals. The process begins with understanding what you want to achieve.

How do you create a realistic financial plan?

How to Create a Financial Plan Like a Pro Define Your Financial Goals. Audit Your Financial Situation. Maximize Your Disposable Income. Develop a Financial Plan That Works for You. Account for Future Scenarios. Commit to a Short-Term Savings Goal. Review Your Progress and Make Adjustments. Adjust as Circumstances Change.

What are the 7 areas of financial planning?

7 Areas Typically Covered in a Financial Plan Financial statement preparation and analysis. Insurance planning and risk management. Employee benefits planning. Investment planning. Income tax planning. Retirement planning. Estate planning.

What is the best way to create a financial plan?

A step-by-step guide to build a personal financial plan Set financial goals. It's always good to have a clear idea of why you're saving your hard-earned money. Plan for taxes. Build an emergency fund. Manage debt. Protect with insurance. Plan for retirement. Invest beyond your 401(k). Create an estate plan.

What are the 4 basics of financial planning?

Some of the most important elements of planning finances include making a budget, building emergency savings, paying off debt, and working toward long-term goals.

What is a realistic financial plan?

“It's money that you need to pay down and put toward savings.” A realistic plan would avoid the use of high-interest credit card debt to accomplish financial goals, such as starting a new business. A realistic financial plan achieves these goals either by increased savings or by low-interest loans.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in financial planning client fact find form without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing financial advisor fact finder and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my financial planning data gathering form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your financial advisor fact sheet and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit financial planning survey questionnaire on an Android device?

You can edit, sign, and distribute retirement planning worksheet on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is StrategicPoint Financial Planning Questionnaire?

The StrategicPoint Financial Planning Questionnaire is a document used to gather information about an individual's financial situation, goals, and preferences in order to develop a personalized financial plan.

Who is required to file StrategicPoint Financial Planning Questionnaire?

Individuals seeking financial planning services from StrategicPoint are typically required to complete the Financial Planning Questionnaire.

How to fill out StrategicPoint Financial Planning Questionnaire?

To fill out the StrategicPoint Financial Planning Questionnaire, individuals should provide accurate and detailed information about their financial status, including assets, liabilities, income, expenses, and any specific financial goals.

What is the purpose of StrategicPoint Financial Planning Questionnaire?

The purpose of the StrategicPoint Financial Planning Questionnaire is to collect relevant financial information that allows financial planners to create tailored strategies to help clients achieve their financial objectives.

What information must be reported on StrategicPoint Financial Planning Questionnaire?

The information that must be reported on the StrategicPoint Financial Planning Questionnaire includes personal details, financial assets, debts, income sources, expenses, investment goals, and any specific financial plans or concerns.

Fill out your StrategicPoint Financial Planning Questionnaire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fact Find is not the form you're looking for?Search for another form here.

Keywords relevant to financial advisor template

Related to financial planning questionnaire

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.