StrategicPoint Financial Planning Questionnaire free printable template

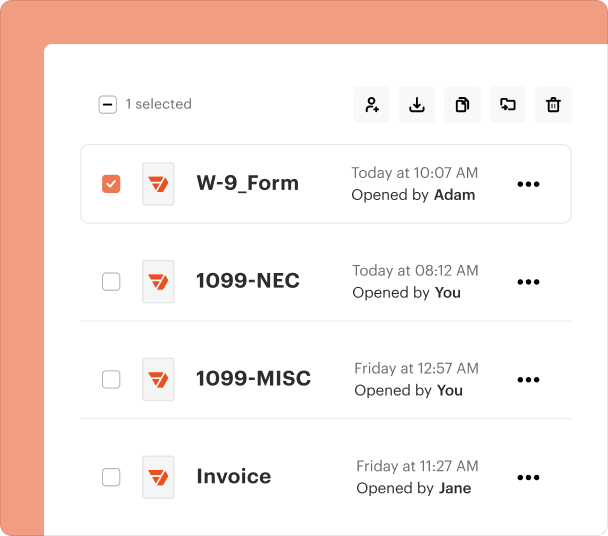

Fill out, sign, and share forms from a single PDF platform

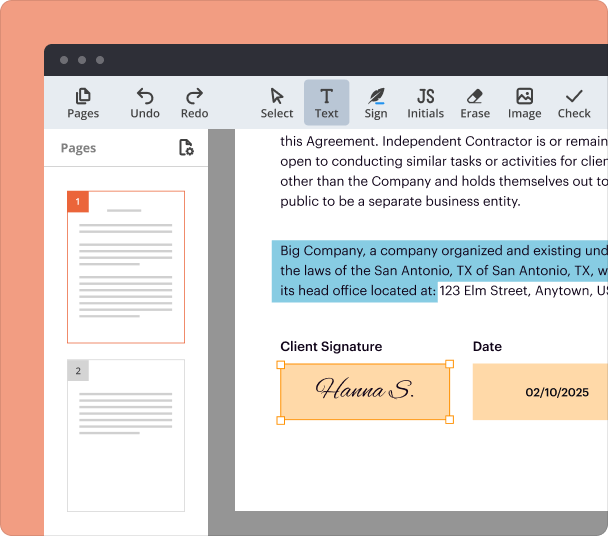

Edit and sign in one place

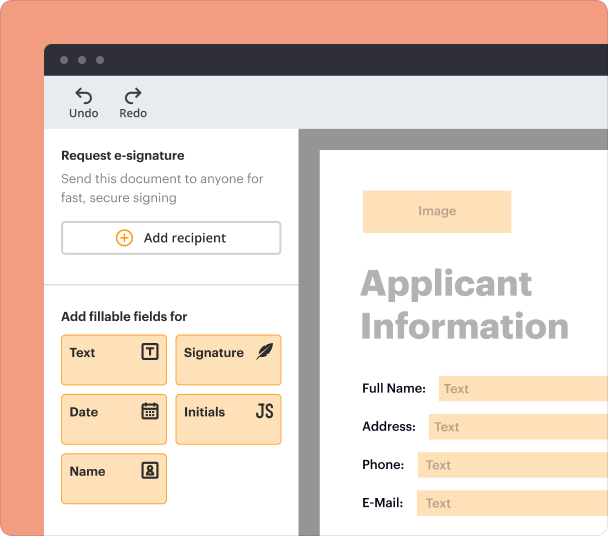

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

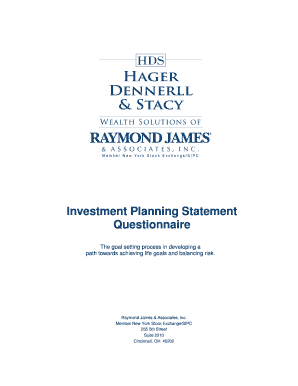

Understanding the StrategicPoint Financial Planning Questionnaire Form

What is the StrategicPoint Financial Planning Questionnaire Form

The StrategicPoint Financial Planning Questionnaire Form is a comprehensive document designed to gather essential information for effective financial planning. This form helps individuals articulate their financial goals, assess their current financial situation, and identify any gaps in their planning. Completing this questionnaire can serve as a foundational step for personalized financial advice tailored to individual circumstances.

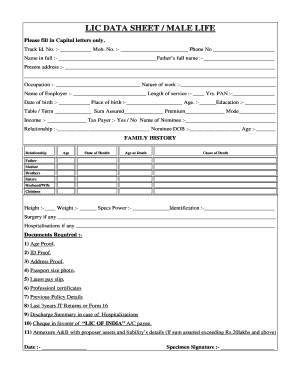

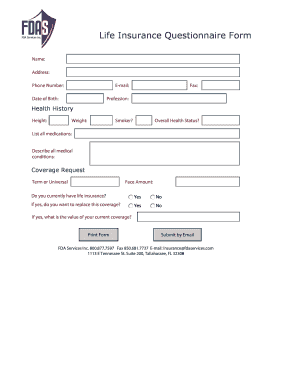

Key Features of the StrategicPoint Financial Planning Questionnaire Form

The form includes several noteworthy features that enhance its utility. It typically covers personal information, financial status, investment preferences, and retirement plans. By integrating this information, users can facilitate clearer discussions with financial advisors. Additionally, the form is designed to be user-friendly, allowing easy completion either electronically or by hand.

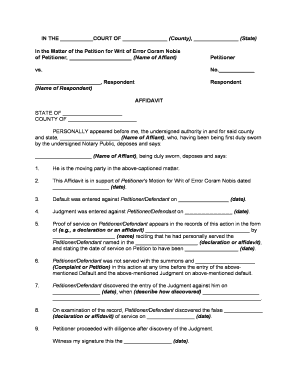

How to Fill the StrategicPoint Financial Planning Questionnaire Form

Filling out the StrategicPoint Financial Planning Questionnaire Form requires careful attention to detail. The process begins by collecting necessary information such as personal identification details, financial assets, and liabilities. Users may complete the form by typing directly into designated fields if using a digital version, or they can write if using a printed copy. It is important to answer all questions accurately, using black or blue ink if completing by hand.

Best Practices for Accurate Completion

To ensure accuracy when completing the StrategicPoint Financial Planning Questionnaire Form, it is advisable to review the form thoroughly before submission. Users should cross-check their information against official documents, such as tax returns and bank statements, to avoid any discrepancies. Additionally, seeking assistance from a financial advisor may help clarify any uncertainties in the form.

Eligibility Criteria for the StrategicPoint Financial Planning Questionnaire Form

Generally, any individual seeking to create a structured financial plan can use the StrategicPoint Financial Planning Questionnaire Form. There are no specific eligibility restrictions; however, it is most beneficial for those with clear financial goals or immediate planning needs. Individuals may also benefit from using the form prior to significant life changes, such as marriage, retirement, or purchasing a home.

Common Errors and Troubleshooting

When completing the StrategicPoint Financial Planning Questionnaire Form, several common errors can occur. Some users may overlook important fields, leading to incomplete submissions. Others might unintentionally provide outdated information. To troubleshoot these issues, it is helpful to double-check all entries and ensure that the most current financial data is being used. If uncertainties arise, consulting a financial professional can provide clarity and assistance.

Frequently Asked Questions about financial planning fact finder form

What is the purpose of the StrategicPoint Financial Planning Questionnaire Form?

The form is designed to facilitate effective financial planning by helping individuals articulate their financial goals and assess their current situation.

Who should fill out the StrategicPoint Financial Planning Questionnaire?

Any individual looking to create a structured financial plan or needing to reassess their financial strategy can fill out this form.

pdfFiller scores top ratings on review platforms